Reasons for Loan Rejection Other than CIBIL

Loading your search...

CIBIL Score = 750+; Loan application = Rejected; Here's why!

CIBIL scores basically tell banks whether or not you?re likely to default on loan payments, based on your history with other banks in terms of loans, credit cards, EMI payments, etc. A score above 700 is considered acceptable, and anything above 750 has a safe chance of working in your favour (considering a range of 300-900).

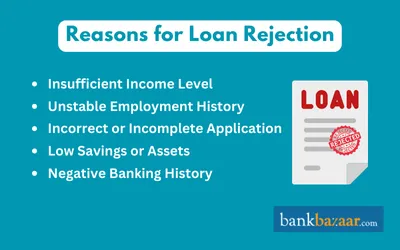

Reasons for Loan Rejection Other than CIBIL

You plan and meticulously detail and define the amount you need to take out a loan for whatever purpose. You decide that all the finances you need are a simple loan approval away and you confidently march your loan application and highly respectable CIBIL score to the bank and submit them for consideration.

Most banks take around 72 hours to approve loan requests and in this time you reflect on how you've done everything required to keep your CIBIL score high enough working hard to make your payments on time, paying the amount promised and play it straight with your bank never asking for extensions, reductions or settlements. You use your credit card in moderation and make your payments before they're due. All this to get your CIBIL score up to a point that will ease the loan application process and ensure that loans are granted. Three days later, the bank performs its due diligence and informs you that your loan application has been rejected!

So What Went Wrong?

CIBIL scores, while they play a huge part in the process, are not the only thing that banks look at before sanctioning your loan. Banks and financial institutions also consider the following:

- Comments in CIBIL Reports - In addition to a numerical score, CIBIL reports also contain remarks and comments by lenders. Banks sometimes offer you the option to settle your loan for a slightly smaller amount than all of your EMIs combined, or offer interest rate reductions, etc. to help you clear your debt. If you settle your loan in any way apart from the terms on which you took the loan, there will be a remark about it in your CIBIL report and this will work against you. If there is any mention of loans being 'written off' or 'settled', or amounts being paid after the due date ('DPD' = Days Past Due), banks take these as warning signs and will reject your loan.

- Standing guarantor on a defaulted loan - A guarantor is considered to be as responsible for loan repayment (even if not in a purely literal capacity) as the borrower. If you have stood guarantor to a loan that has been defaulted, this will affect your CIBIL score and report in a negative way.

- Defaulter details matching - Banks and financial institutions maintain lists that contain the name, age, address, current employment, and other details of individuals who have defaulted on their payments. If the details you have submitted are (even mistakenly) matched with a defaulter, you will be denied a loan before the bank even checks your CIBIL rating. There have been instances where those who have moved into houses previously occupied by defaulters and submitted that address have been matched with the 'address' records of defaulters, suffocating their chances of securing a loan.

- If you are overleve'raged - You can only assign a certain amount of your declared income to clearing debts. If you earn Rs.50,000 per month, and have three other loans youre clearing by paying Rs. 10,000 per month, each, you're left with Rs. 20,000 for survival and personal expenditure. Banks will not approve another loan and will deem you overleveraged. Your DTI (debt-to-income) ratio will be unfavourable and you will not be able to allocate more of your income to clearing off your new loan.

- Inadequate tax-paying history - Banks generally prefer applications from those who have been actively filing income tax for at least two years prior to the application. It is easier to judge the creditworthiness of such individuals as there is an existing record apart from CIBIL that can nudge them in the right direction.

- Over-borrowing - If you have taken out too many loans in the previous year, regardless of whether you were able to honour them or not, banks will not approve your loan as they deem such individuals as credit hungry. Even though your record is clean, you will be considered a risky candidate who can default at any time.

- Ratio of secured loans to unsecured loans - Secured loans are those taken against securities like assets or with a guarantor (home loans, automobile loans, etc.) and unsecured loans are taken without any security (personal loans, credit cards, etc.). A favourable ratio would be one which has more secured loans than unsecured ones.

Anything else I should keep in mind to be viewed favourably by lenders?

As it's clear by now, sometimes loan applications can get rejected through no fault of your own, it is important to be diligent and actively involved in managing your finances. It's also recommended that you check your CIBIL report once every six months to ensure that everything is as you left it.

What is the Perfect Credit Score to Have a Credit Card Application Approved?

A credit score is just three digits and the importance given to those three digits by banks and other lenders has grown significantly over the years. Any loan a person is looking for: home loan, car loan, personal loan, or a credit card, the prospective lender check the applicant's credit history before approving the application.

So, what is the perfect score to avail a credit card? You can read on to find out.

A typical credit score ranges from 0 to 850 and the score between these are categorised into 5 different levels. The higher the score is, the better a person's chances are of getting a loan or a credit card. So, in the search of a perfect score, let's first see how they are categorised.

0 - 600:

Any score between this means that the lender will most likely be running for the hills when you apply for a line of credit line. This score shows that you are really Poor with money and handling loans. So, the only option for a person with score to get a credit card is by getting a secured card.

601 - 700:

While score between this range isn't as bad, as the previous category, it is still bad. Some lenders may not outright reject an applicant of this category, but they certainly will waste their time, scratching their head thinking if the applicant is worth the risk. There is a slightly high chance of rejection involved here though, unless they can opt for a secured card, as in the case of the previous category.

701 - 750:

This gets lenders talking. They are often waiting for people within this range to apply for a card. And, when they do, they mostly approve them. The case or rejection comes in when the applicant overreaches and applies for a card beyond their present ability. But, maintaining a score within this range means you are most likely walking away with a credit card in a few weeks time.

751 - 850:

This is the best possible applicant credit card company would look for. If your score is within this range and you meet the basic eligibility, your application for a new credit card is as good as approved. Scores within this range shows that the applicant is extremely reliable and carries little to no sense of risk for the lender. The score shows that the person will always clear bills on time and keep very little outstanding on their card and will always remain reliable and trustworthy for the bank.

As specified, banks never offer a loan or a credit card to individuals they think are a risk and those who run a high risk of defaulting. So, to sum it up it's always better to keep your credit score between 701 - 850 to have your application accepted at the earliest.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

FAQs on Reasons for Loan rejection

- Are there any other rejections that happen by association?

Yes, if you work in a location where a large number of your co-workers have defaulted on loan payments in the past and/or have bad credit scores, the lender will reject your application as you are associated with these people. The lender will assume that since so many of them defaulted on their debts, the company may not be stable in their monthly salary disbursements, or there may be some issue with the company as all the defaulters have only their employment details in common with each other.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.